In the vibrant mosaic of global entrepreneurship, an unmistakable gap tells a story of unrealised potential: the lack of financial investment in women-led startups. It’s more than a funding disparity; it’s a missed opportunity and stifling innovation.

It looks like, this is why the UK government has set up a business taskforce to create voluntary targets (yes, I know it’s ‘voluntary’ but I guess better than nothing, right?) for investment firms to meet. Oh, and it was conveniently announced in the run-up to International Women’s Day. The Women-Led High-Growth Enterprise Taskforce is chaired by Anne Boden, founder of Starling Bank and the first woman to set up a bank in the UK.

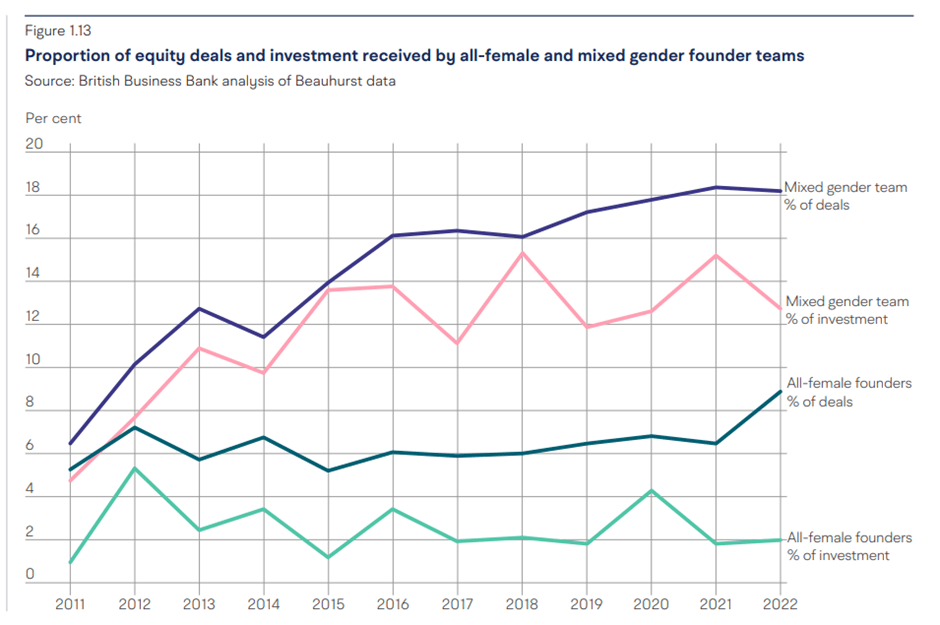

Funding Disparities: In 2022 female entrepreneurs in the UK routinely received less than 2% of venture capital investment funding*.

Women’s History Month is commemorated every year in March celebrating the contributions of women to events in history and contemporary society. The most recognised day in the month is International Women’s Day.

However, for every prominent female entrepreneur celebrated, many more toil in obscurity trying to bootstrap their businesses, because it’s tough for women to get investment.

The taskforce’s report defines:

A high-growth enterprise as having an average annualised growth greater than 20% per annum, over a three‑year period, measured by the number of employees or turnover, with at least 10 employees in the baseline year.

A ‘women-led’ high growth enterprise as not being entirely led by females but having at least one woman in a top three position (CEO, CFO, CTO) and women should hold at least 25% of founders’ equity.

The Rose Review concluded that up to £250 billion could be added to the UK economy if women started and scaled new businesses at the same rate as UK men. *

Funding female entrepreneurship is a strategic economic decision that can steer industries towards equitable growth.

Currently, high-growth enterprises contribute £160 billion of turnover for the economy, but when it comes to female high-growth entrepreneurship the main barrier to progress is getting access to funding. For the last decade the stats have not improved, remember, for every £1 of equity investment in the UK, 2p goes to fully female-founded businesses. According to the taskforce, women entrepreneurs are underrepresented compared to men in every sector reviewed where gender data was available:

Personal Services, Craft Industries, Leisure and Entertainment, Retail, Media, Industrial, Transport operators, Business and Professional Services, Supply Chain, Tradespeople, Energy, Tech/IP-based businesses, Telecommunications, Infrastructure, Agriculture, Forestry and Fishing.

The graph above from the British Business Bank’s Small Business Equity Tracker 2023, shows that all-female founder teams received a record 9% of all deals in 2022, whilst only receiving 2% of total investment. This represented 218 deals during the year and £304m in equity funding.

This is one of the reasons why I’ve curated the free Hear the Hustle business funding directory, which contains alternative finance sources outside of traditional bank loans. Another reason is that most of my digital marketing clients would complain about how hard it is to get funding to scale their businesses. Some of the organisations focus on supporting women business owners specifically, click here to get a copy and send it to all the business owners, hustlers and side-hustlers who are looking for funding to scale their ventures!

Innovation and growth thrive on diverse perspectives

Compared to men, women are underrepresented in every business sector investigated by the taskforce. Currently, 18% of high-growth enterprises include one or more women on the founding team, versus all-male founding teams which make up 82% of high-growth enterprises. It’s been well-reported that diversity can lead to better discussions, decisions and profitability.

Female entrepreneurs are more likely to identify and address market gaps, particularly in sectors that disproportionately affect women. The low representation of women entrepreneurs is a missed opportunity at both a societal and economic level.

Part of the problem is that fewer women apply for funding and I’m sure there are various reasons for this, which could be similar to why it’s been said that women are less likely to ask for a raise when working for others.

However, when women do apply for funding the chances of them getting a cheque is low and if they are lucky enough to get some cash, it’s usually significantly lower than what male entrepreneurs get.

Corporate Partnerships can also be an avenue to catalyse female-led startups

Corporations have the financial muscle, networks and resources to boost women-owned startups. Partnerships between established companies and fledgling enterprises can lead to a mutually beneficial ecosystem for growth and sustainability.

This drive to increase investment in women-led high-growth businesses also aligns with Industry 5.0

Defined by the European Union as “a future vision to achieve societal goals beyond jobs and growth. Industry would become a resilient provider of prosperity, by making production more sustainable and placing the wellbeing of the worker at the centre of the production process.” The taskforce claims that the cost of living crisis, and struggling public services as seen in NHS waiting lists, are all opportunities for women entrepreneurs, who are usually more prominent in socially productive areas including healthcare, education, climate change and consumer-facing solutions.

Empowering women in business as leaders has a ripple effect through communities and economies. Reports indicate that women are more likely to invest their earnings back into their families and communities, amplifying the positive impact of their ventures.

It’s no secret that accessing funding for women entrepreneurs is difficult as it has been for years

For change to materialise, funding women-led startups and women founders will need to be the collective responsibility of the whole financial ecosystem. Let’s watch this space!

The Purpose Copywriter and Content Strategist

*Reference: Women-led high-growth enterprise taskforce report; February 2024

Leave a reply to Business Funding Directory – The Purpose Copywriter and Content Marketing Strategist Cancel reply